Advertising spend predicted to grow 4.1% in 2024

Advertising spend is predicted to grow by 4.1% this year, according to marketing advisory firm Core.

That marks a slightly slower pace of growth than the 4.6% seen in 2023, however it would bring the total amount spent here to €1.534 billion.

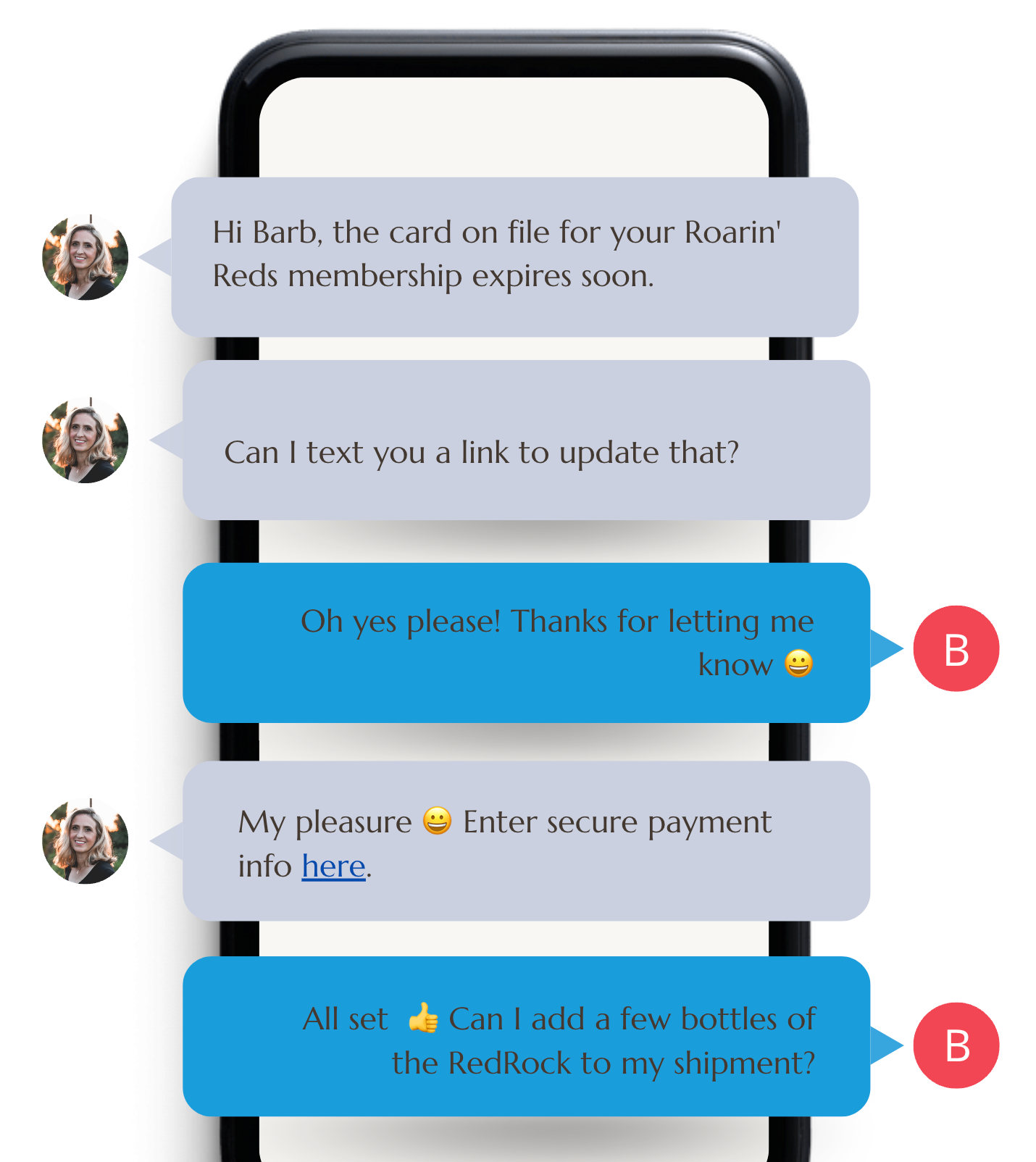

The majority of that money – 64% – is going towards digital channels, with €912.8m spent there last year.

Core expects that to grow by 7.85% this year, to €984.5m, with social media and video seeing the biggest increases within that.

“In the second half of last year we saw a lot more positivity across the advertising industry,” said Colm Sherwin, chief digital and investment officer with Core.

“There is an awful lot more positivity on the back of declining inflation rates, the expected declining interest rates, and only in the last two weeks or so, the latest Credit Union Consumer Sentiment Index shows you consumer sentiment has increased substantially.”

Spending on audio adverts is one of the areas predicted to benefit from this, with a 1.8% increase to €157.7m this year.

“Radio has performed really, really well over the last five years or so,” he said. “Radio benefitted substantially throughout the pandemic… the natural assumption is that you would have seen a decline in ad spend (after the peak of the pandemic) but that hasn’t happened.

“Even though digital audio is disrupting this sector it’s still quite small – it’s only around 11% of overall consumption.”

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

Mr Sherwin said there is also a blurring of the lines between broadcast and digital audio – with some traditional programming now being consumed as podcasts.

In its outlook, Core said increased collaboration between traditional broadcasters and streaming or podcasts “would be welcomed by the industry”.

Meanwhile a strong release schedule will see a 17.7% pick-up in cinema ad spend, though that comes after an 11.8% dip in 2023.

TV ad spend is predicted to decline this year by 3.9% – following a 5.8% dip in 2023.

That will bring spending to €234.7m, according to Core.

“Naturally what’s happened over the last 10 years or so is we’ve seen substantial fragmentation across how are people are consuming TV,” said Mr Sherwin, though he added that there was some potential for that figure to be better than predicted.

“In July to September last year we actually saw growth in TV, so whether it was the Irish weather or whether it is actually the investment by an awful lot of the broadcasters in live sport, we saw an increase in consumption during that period.

“Whether that’s going to continue into 2024 is one to watch.”

Core also expects a continued decline in ad revenue for news media – with a 13.1% fall in print far out-pacing the 7.1% rise in digital revenues.

However Mr Sherwin said that, in a year of elections in Ireland, Europe and beyond, there was potential for news organisations to put themselves forward as a reliable partner in the coming months.

“I think this is a chance for print media – and all news media – to maybe stand up and own this space. All of the negative you see around misinformation and disinformation, this is a chance for these guys to publisice how the content is verified,” he said.

“A study done in the UK by Newsworks, from an advertisers’ perspective, if your ad appears against tried and trusted content from an effectiveness perspective, you can see uplifts of engagement of four to five times.”